Authors: Sheikh Ali Alwaleed Al Thani, CEO, Investment Promotion Agency Qatar (Invest Qatar), and Sheikh Mohammed H. F. Al-Thani, CEO, Qatar Free Zones Authority (QFZ)

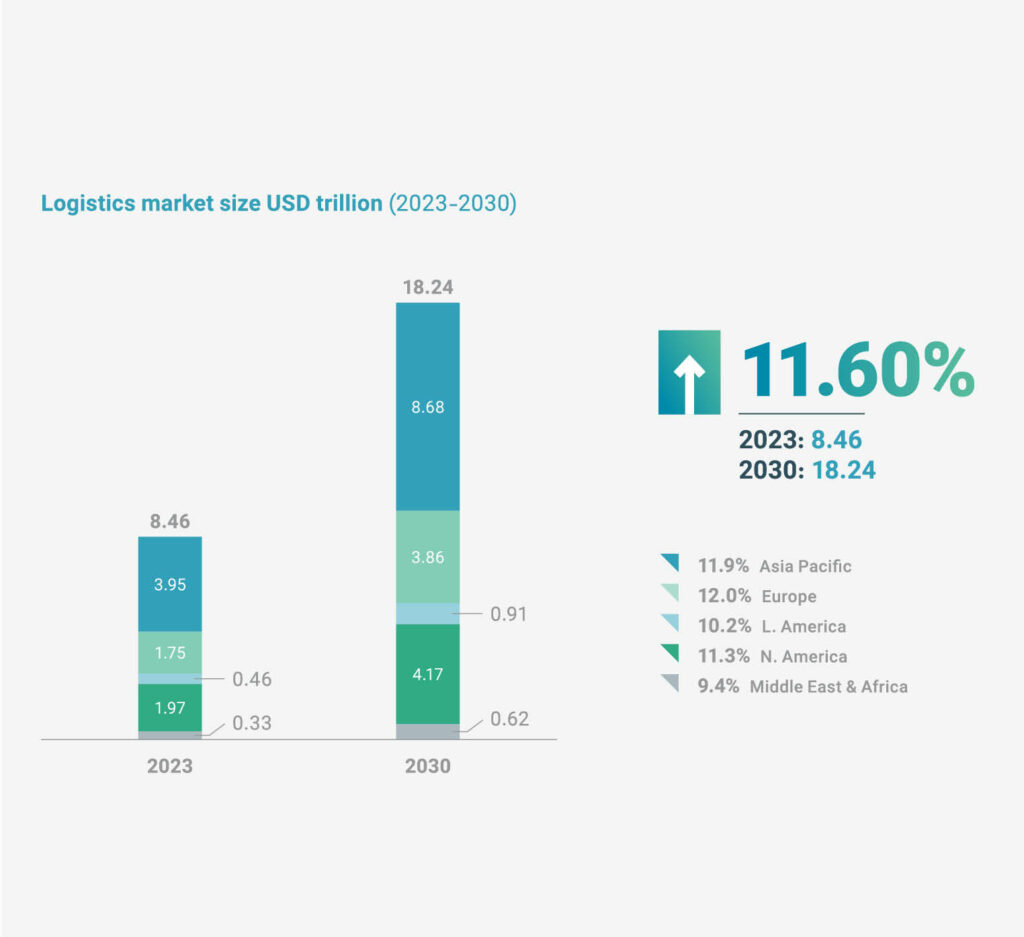

From natural disasters and health pandemics to geopolitical tensions, shifts in economic powers and the rise of innovative technologies, the landscape of international trade has undergone unprecedented changes over the past decade. The logistics industry’s capacity for agility, development and readiness has come to the forefront of global trade, serving as the cornerstone for uninterrupted commerce. With a valuation of $5.8 trillion in 2018 to a staggering $10.41 trillion by 2023, with estimations surpassing $18 trillion by 2030, the industry’s upward trajectory underscores its resilience and growth potential. However, the latest global trade update by the United Nations Conference on Trade and Development (UNCTAD) paints a different picture. Persistent geopolitical tensions, surging shipping costs and substantial levels of debt, among other factors, could continue to pose challenges and potentially alter the course of global trade. Bottom of Form With a convergence of promising trends and challenging factors, the question arises: where does the logistics sector stand at this crossroads?

Source: Qatar’s logistics landscape: Achieving excellence and future-proofing the supply chain.

Navigating five trends shaping logistics growth

AI and E-commerce expansion

The demand for faster, more efficient and cost-effective logistics solutions continues to rise, driving e-commerce as one of the leading adopters of artificial intelligence (AI). This trend is particularly relevant in Qatar, which boasts the top ranking for ‘Data and Infrastructure’ for AI readiness in the GCC region according to the 2023 AI Readiness Index. Through sophisticated algorithms and machine learning techniques, AI enables e-commerce platforms to analyse vast volumes of data, anticipate consumer needs, optimise pricing strategies and logistics, and tailor product recommendations, enhancing customer satisfaction and loyalty. Given this transformative influence, AI is expected to reach $12.87 billion by 2026 in the logistics market, according to the Gitnux Market Data Report 2024. Industry giants like Amazon and DHL are integrating AI into their operations, to drive innovation and elevate customer experiences in the ever-evolving realm of e-commerce.

Sustainability

With sustainability concerns looming large, logistics enterprises are adopting eco-friendly practices and embracing zero-carbon shipping solutions to mitigate environmental impact. Emerging trends in sustainable logistics, including adopting alternative fuels, electric vehicles and carbon offset programmes, shed light on sustainable transportation with zero-carbon shipping becoming more accessible. According to DHL, the transportation industry accounted for 24% of global greenhouse gas emissions in 2023, which has also committed to reducing its logistics-related emissions to net zero by the year 2050. This shift towards sustainable supply chains is not just about reducing environmental impact; it is also about enhancing efficiency, saving costs and enabling resilience in an ever-changing world.

Bridging talent gap: addressing the need for skilled labour

As experienced professionals retire and skilled labour becomes scarcer, logistics companies, in collaboration with their local governments, face the challenge of attracting, retaining and upskilling talent. According to a survey conducted by MHI and Deloitte, 57% of survey respondents report difficulties in hiring and retaining qualified workers. Hence, governments worldwide are implementing multifaceted strategies to foster talent development and bridge workforce gaps.

For instance, Germany has established a highly successful vocational education and training (VET) model that allows a hands-on approach to equip students with relevant skills. Meanwhile, other countries are launching government-backed residency initiatives to attract talent. In Qatar, Jusour (Qatar Manpower Solutions Co.) recently launched the Mustaqel programme, which is designed to invograte the nation’s labour market by attracting entrepreneurs, unique talents and skilled professionals from across the world to Qatar. The programme offers unique benefits and a renewable five-year residency permit, enticing individuals to contribute their expertise to Qatar’s workforce.

Re/Near-shoring strategies – Bringing it home

The disruptions caused by global crises and geopolitical tensions have prompted many companies to reassess their offshoring strategies. In 2024, the trend towards localisation and regionalisation of supply chains is gaining momentum. By bringing production and distribution closer to end markets, companies aim to reduce dependency on distant suppliers, mitigate geopolitical risks and enhance responsiveness to changing consumer preferences. Globally, over half (57%) of the companies surveyed by QIMA reported that nearshoring is a key part of their supply chain strategy in 2023 and beyond. Re/near-shoring strategies not only offer logistical advantages such as shorter lead times and reduced transportation costs but also support job creation and economic growth in local communities.

Geopolitical shifts

Geopolitical events can shape both short-term and long-term strategic implications on shipping rates, trade flows and global supply chains. The surge in trade tensions between the United States and China since 2018 significantly impacted global logistics, with tariffs affecting over $700 billion in goods in 2019 alone, according to the World Trade Organization (WTO). Additionally, the Russia-Ukraine War resulted in increased prices of commodities, increased freight charges, container shortages, and lowered the availability of warehousing space and closure of several ports. Similarly, the unrest in the Middle East, coupled with attacks on vessels transiting through the Suez Canal, has added to the existing challenges, decreasing Suez Canal transits by an estimated 42% compared to its peak according to UNCTAD. The search for alternative routes due to these factors results in longer cargo travel distances, rising trade costs and insurance premiums.

The Road Ahead

Returning to the pivotal question posed earlier regarding the current position of the logistics sector at this critical juncture, the response may diverge depending on the country in question. While some nations may perceive the prevailing trends as opportunities for growth, others may grapple with direct challenges.

Globally, looking at the leading countries ranked by the World Bank’s Logistics Performance Index, namely Singapore, Germany and the Netherlands, it becomes evident that they prioritise innovation and collaboration. These nations leverage emerging technologies such as blockchain, Internet of Things (IoT) and AI to optimise supply chain operations and enhance efficiency. Furthermore, governments are forging partnerships with private sector stakeholders to foster innovation and address pressing challenges such as sustainability and digitalisation.

As we contemplate the future trajectory of the logistics sector, it’s clear that nations worldwide are recognising a unifying theme: an escalating shared emphasis among countries on investing in infrastructure, technology and talent development to fortify their logistics sectors. Qatar, positioned at the forefront of this global endeavour, stands as a beacon of innovation and progress. The country ranks 7th globally in logistics competence according to the Agility Emerging Markets Logistics Index 2024, while 2nd in the region for access to technology according to the Network Readiness Index 2023.

Qatar Free Zones Authority (QFZ) is a key enabler of the logistics sector in the country, spearheading various initiatives to bolster its expansion. To date, QFZ hosts four of the top ten global logistics enterprises and continues to incorporate new technologies like artificial intelligence in logistics as well as the development of new assets including brand-new Regional Distribution Hubs. These efforts further bolster Qatar’s logistics infrastructure and attract new entrants into the market, further enhancing the nation’s position as a leader in the global logistics landscape.